RESOURCES

Closing Costs

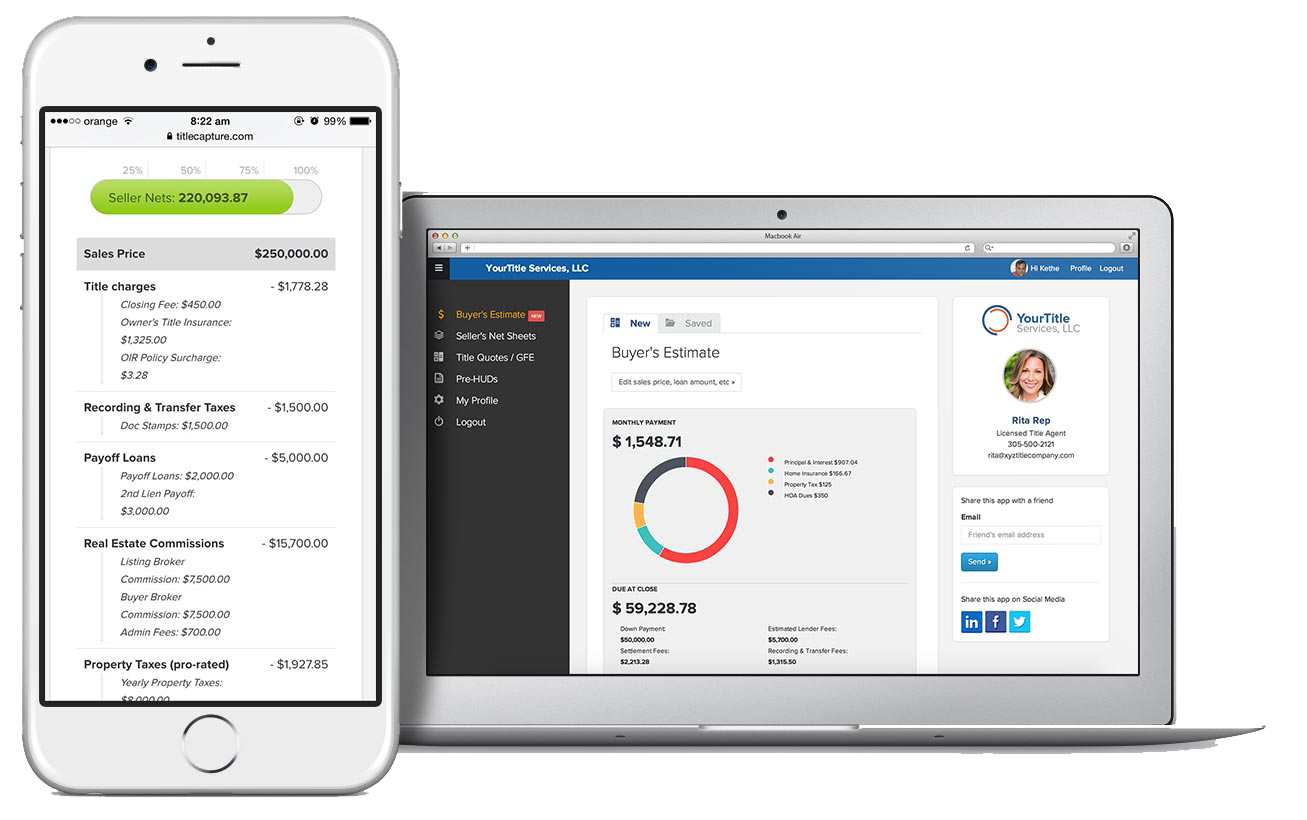

There’s an App for That!

Our complimentary app is a useful research tool to assist in the home buying and selling process. With a few simple clicks, the Heritage Union Title mobile and online app provides instant access to important financial information 24/7. It’s ideal for sellers, buyers and realtors.

Sellers: Is your asking price too high or too low? Our app will help you estimate net proceeds and a breakdown of expenses surrounding your sale.

Buyers: Plan your down payment, get an idea of closing costs and determine the amount of your monthly mortgage payment.

Realtors: Give your buyers and/or sellers an estimate of housing expenses on-the-go and after regular business hours.

Understanding the Ohio Good Funds Law

The Ohio Good Funds Law became effective April 6, 2017. For transactions involving residential real estate, settlement agents may disburse only when the funds for the transaction qualify as Good Funds, as defined by Ohio statute*. Learn More.

Realtors

When your real estate needs encompass more than one county, Heritage Union Title can provide a single point of contact covering multiple territories.

Helpful Links:

Forms & Calculators

FOR SALE BY OWNER RESOURCE LIBRARY

Not working with a realtor? Our resource library offers helpful guides and pertinent forms required to sell a home in the State of Ohio. Once you have signed the below purchase agreement, simply forward a copy to Heritage Union Title so that we can begin the title process.

Our ‘For Sale By Owner’ Resource Library is complimentary and includes:

Contact County Auditors

Quickly access property records and inquire about appraisals by contacting the County Auditor’s office.

Frequently Asked Questions

There are a lot of important questions surrounding the process of buying or selling a home. The following FAQs should help you on your real estate journey.

Can I sell my property without using the services of a real estate agent?

Do I need to have a title search when buying a home?

I closed the purchase of my home last year, and I just got a tax bill. Shouldn’t that be the Seller’s responsibility to pay?

I just signed my purchase agreement to buy a house. How long with the process take?

Do I really need to spend the money on a title policy? What protection does it give me?

- Unpaid mortgages

- Unpaid property taxes

- Child support liens

- Missing heirs who could claim the property belongs to him or her

- Missed easements or rights of way that could limit your use of the property

There are two types of title insurance policies. As mentioned, the owner’s policy protects the homebuyer. A loan policy protects the lender. Most lenders usually require a loan policy when they issue you a loan. The loan policy is based usually on the dollar amount of your loan. It only protects the lender’s interests in the property should a problem with the title arise. It does not protect the buyer. The policy amount decreases each year and eventually disappears as the loan is paid off. An owner’s policy, usually issued in the amount of the real estate purchase, provides protection for as long as you or your heirs have an interest in the property.

Understanding the Basics of the Ohio Good Funds Law

New Ohio Good Funds Law goes in affect April 6, 2017. For transactions involving residential real estate, settlement agents may disburse only when the funds for the transaction qualify as Good Funds, as defined by Ohio statute*.